Online trading is the act of buying and selling financial securities through any online brokerage account. Online trading typically involves placing orders for stocks, bonds, mutual funds, and other types of securities with a broker, who then executes the trades on behalf of the investor.

There are many different types of online trading platforms available to investors today for automatic trading or day trading uk is the best place for trading. Some platforms are designed for experienced traders who are familiar with the ins and outs of the market. Other platforms are more user-friendly and geared towards beginner investors.

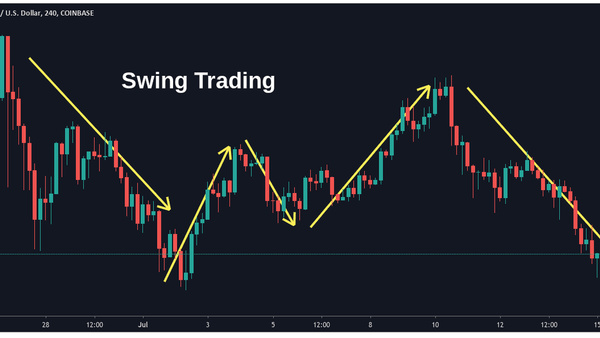

What is Swing Trading?

Swing trading is a type of investment strategy that attempts to take advantage of short-term price movements in order to earn quick profits. This approach to trading is often used by more experienced traders, as it can be riskier than other strategies.

With swing trading, you are looking to buy or sell a security at a point where the trend is likely to change direction. You then hold that security until it reaches your target price, and then you sell it. Because you are taking advantage of short-term price movements, swing trading can be more volatile than other approaches, but it also offers the potential for greater profits.

How do I get started with Swing Trading?

If you’re interested in learning how to swing trade, there are a few things you need to know. First, you need to find a security that is likely to have a large price movement. You can do this by looking at charts and searching for stocks that are near their 52-week high or low.

Once you’ve found a security that you’re interested in, you need to determine the right time to buy or sell it. This can be done by watching the market and looking for patterns. For example, if the stock is moving higher, you might want to buy it when it reaches a support level. If the stock is moving lower, you might want to sell it when it reaches a resistance level.

Finally, you need to set a target price for the security and use stop losses to protect your investment.

What are the risks of Swing Trading?

Swing trading is a more advanced investment strategy, and as such, it comes with a higher degree of risk. If you’re not careful, you can easily lose money by swing trading.

One of the biggest risks when swing trading is using too much leverage. When you borrow money to buy stocks, you are using leverage. This increases your risk if the stock moves against you.

Another risk associated with swing trading is liquidity. If you need to sell a security quickly, there may not be enough buyers in the market to get a good price. This could lead to a loss on your investment.

How can I reduce the risks of Swing Trading?

While swing trading is a more risky investment strategy, there are ways to reduce your risk. First, you should always use stop losses to protect your investment. This will help you avoid large losses if the stock moves against you.

Second, you should only trade stocks that have high liquidity. This will help ensure that you can sell your stocks quickly if you need to.

Finally, you should only use a limited amount of leverage when swing trading. This will help minimize your risk if the stock moves against you.

How can Swing Trading be profitable for us?

When it comes to swing trading, we are looking for stocks that are not only moving but also have enough volatility so that we can make a profit on our trades. Volatility is key when swing trading and can be the determining factor on whether or not a stock is a good candidate for swing trading.

There are several strategies that we can use when swing trading and one of the most popular is the breakout strategy. This involves looking for stocks that have been consolidating in a range and then waiting for them to break out of that range before taking a position.

Another strategy that we can use is the trend following strategy. With this strategy, we are looking for stocks that are trending in one direction and then taking positions in the direction of the trend.

Both of these strategies can be profitable if done correctly but it is important to remember that swing trading is a higher risk/higher reward type of trading so we need to be careful when selecting our stocks and managing our positions.