Natural gas prices in Europe experienced a significant spike, surpassing 2% to reach 29 euros per megawatt-hour (MWh) on Monday. The surge came after reports emerged of a Russian attack on an underground natural gas storage facility in Ukraine. Despite the escalation, Ukraine’s state energy company Naftogaz assured that gas supplies to Ukrainian consumers remained unaffected.

Naftogaz CEO Oleksiy Chernyshov addressed the situation, stating, “We have enough spare capacity to mitigate any immediate impacts.” He emphasized that the supply of natural gas to Ukrainian consumers remained intact despite the attack on the storage facility.

This attack represents the latest in a series targeting energy infrastructure in Ukraine, which has resulted in power outages in several cities. Ukraine’s largest power producer, DTEK, reported a 50% loss of production capacity, leading to the cessation of electricity exports, as announced by the country’s energy ministry.

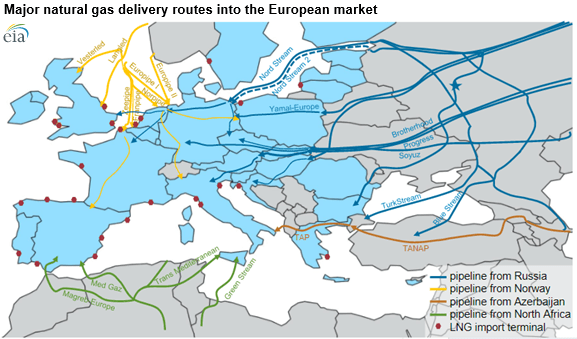

The news of the Russian attack on a gas storage facility raised concerns in Europe, particularly as the European Union had been sending additional gas to Ukrainian storage facilities after its own were filled. Ukraine’s capacity, provided by its state-owned energy company, represented a significant portion of its total storage capacity.

Foreign energy traders had reserved a substantial portion of this capacity, with plans to fill it earlier than usual this year. Naftogaz aimed to accommodate European energy traders by filling its gas storage facilities with 4 billion cubic meters this year.

Although most of Ukraine’s gas storage facilities are located in safer, western regions away from the conflict zones, today’s attack contributed to a rise in natural gas prices in Europe. The increase, however, remains below the six-week high recorded on March 19.

The surge in natural gas prices is further compounded by ongoing attacks on energy infrastructure in Russia and Ukraine, as well as concerns about supply disruptions following recent geopolitical tensions in the region.

Meanwhile, US liquefied natural gas exporter Freeport LNG reported operational updates, with one liquefaction line returning to production while others undergo inspections and repairs.

Despite the current price surge, forecasts suggest that gas prices may revert to a downward trend as Europe transitions out of the heating season. Stable production from Norway, increased solar influence, and stable European gas stocks are expected to alleviate upward price pressures in the coming months.